how to pay indiana state withholding tax

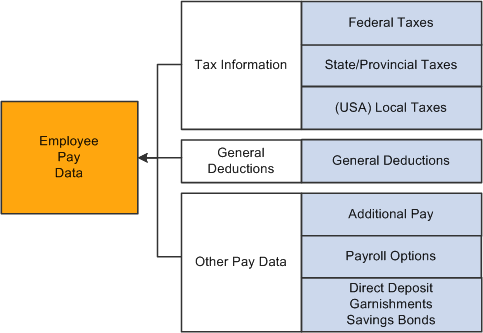

You can also make your estimated tax payment online via INTIME at intimedoringov. Once in the employee record Click the Payroll Info tab.

Tax Withholding For Pensions And Social Security Sensible Money

Click the Other tab.

. In Indiana state UI tax is just one of several taxes that employers must pay. 4927-T Michigan Pension and Retirement Payments Withholding Tables. You may also need to complete the FT-1 application for motor fuel taxes including special fuel or transporter taxes or the AVF-1 application for aviation fuel excise tax.

Take the renters deduction. Claim a gambling loss on my Indiana return. Casinos typically withhold 25 of your winnings for tax purposes.

Accessing from Employee Center. From the Item Name list select Indiana Counties Tax. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return.

Option 2 is through Payroll Setup. Taxpayers pay the tax as they earn or receive income during the year. If you are mailing your Indiana return the complete filing instructions should print with your state return including the address to mail.

August 2019 this Fact Sheet has been updated to reflect changes to the Withholding Tool. All payments must be made with US. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our Taxpayer Assistance Division at 1 800 732-8866 or 1 217 782-3336.

Here are the basic rules for Indianas UI tax. INtax only remains available to file and pay the following tax obligations until July 8 2022. Another 10 have a flat tax rateeveryone pays the same percentage regardless of how much they earn.

Find Indiana tax forms. Every employer in this state who is required to withhold federal income tax under the Internal Revenue Code must be registered for and withhold Michigan income tax. The Waiver Request must be completed and submitted back to the Department.

Overall state tax rates range from 0 to more than 13 as of 2021. FS-2019-4 March 2019 The federal income tax is a pay-as-you-go tax. Have more time to file my taxes and I think I will owe the Department.

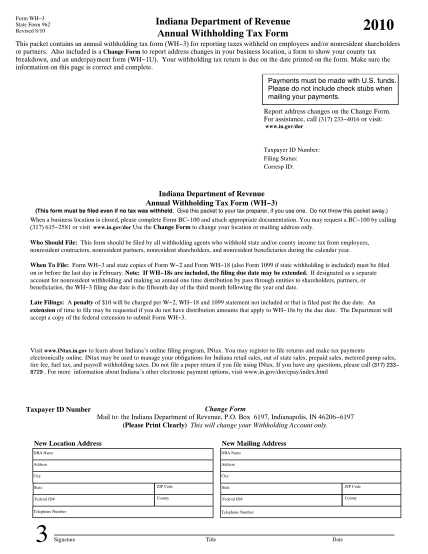

Employers required by the Internal Revenue Service to withhold income tax on wages must register with the Indiana Department of Revenue DOR as a withholding agent online through INBiz httpinbizingov. Who is required to register for withholding tax. Once registered an employer will receive an Indiana Taxpayer Identification Number.

California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in the country and eight states have no tax on earned income at all. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Find Indiana tax forms.

Take the renters deduction. Know when I will receive my tax refund. INTAX only remains available to file and pay special tax obligations until July 8 2022.

Pay my tax bill in installments. Credit card payments may be made through the Ohio Business Gateway OBG or over the Internet by visiting the ACI Payments Inc. Have more time to file my taxes and I think I will owe the Department.

Enclose your check or money order made payable to the Indiana Department of Revenue. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. There is a service fee charged by ACI Payments Inc.

Taxpayers can avoid a surprise at tax time by checking their withholding amount. You can pay those Indiana state taxes due directly online to Indiana at the web site address here select Individual Tax Return. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown Indianapolis location using cash exact change only personal or cashiers check money order and debitcredit cards fees apply.

446-T Michigan Income Tax Withholding Tables. But in general there are two main pages to the IT-40 Indiana full year resident returnYou will sign the second page of the IT-40 and place all other pages of the tax return behind it. Different states have different rules and rates for UI taxes.

Almost all gambling winnings are subject to this tax. Pay my tax bill in installments. That is only the norm if you provide them with your social security number however.

Pay the amount due on or before the installment due date. Know when I will receive my tax refund. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247.

Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. If you decline that option they usually withhold 28. You can use your American Express DiscoverNOVUS MasterCard or Visa credit card to pay your withholding tax liability.

Claim a gambling loss on my Indiana return. To register for Indiana business taxes please complete the Business Tax Application. While taxpayers due a refund receive no penalty for filing late those who owe and missed the deadline without requesting an extension should file quickly to limit penalties and interest.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Write your Social Security number on the check or money order. IR-2022-91 April 19 2022 The IRS encourages taxpayers who missed Mondays April 18 tax-filing deadline to file as soon as possible.

Currently Indianas personal income tax rate is 323. New field is labeled County subject to withholding select the applicable county.

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

19 Indiana Tax Forms Free To Edit Download Print Cocodoc

Calculating Your Withholding Tax Inside Indiana Business

Peoplesoft Payroll For North America 9 1 Peoplebook

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

State W 4 Form Detailed Withholding Forms By State Chart

Iwt Definition Interest Withholding Tax Abbreviation Finder

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

2022 Federal State Payroll Tax Rates For Employers

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

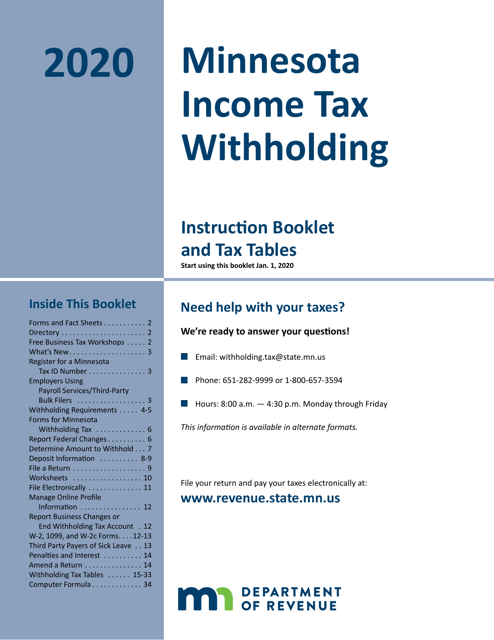

2020 Minnesota Minnesota Income Tax Withholding Download Printable Pdf Templateroller

How Taxes Work Taxes Social Security Numbers Visas Employment Office Of International Affairs Indiana University Purdue University Indianapolis

Peoplesoft Payroll For North America 9 1 Peoplebook

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding